income tax rate indonesia

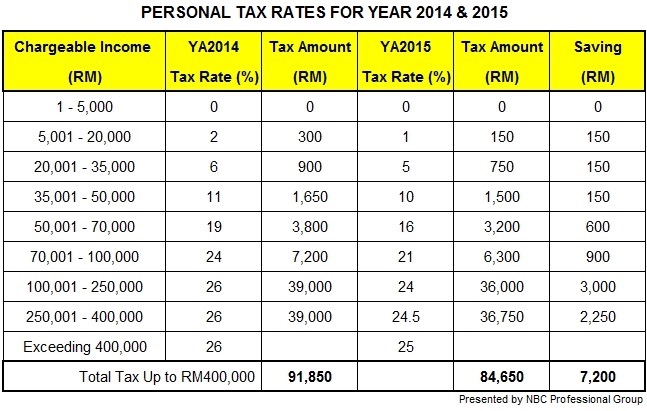

This applicable tax rates are progressive based on annual income. Indonesia Individual Income Tax Guide 9 Individual Tax Rates Resident Taxpayer The standard tax rates on taxable income received by resident taxpayers are as follows.

Asean Regulatory Brief Cit Incentives Pit Changes Export Management Fees Vat On E Commerce And More Asean Business News

The Tax tables below include the tax rates thresholds and allowances included in the Indonesia Tax Calculator 2020.

. In general a corporate income tax rate of 25 percent applies in Indonesia. Companies listed on the Indonesia Stock Exchange IDX that offer at least 40 percent of their total share capital to the public obtain a 5 percent tax cut hence a tax rate of 20 percent applies for these public companies. Indonesia Personal Income Tax Rate The Personal Income Tax Rate in Indonesia stands at 30 percent.

Direktorat Jenderal Pajak 10Y 25Y 50Y MAX Chart Compare Export API Embed Indonesia Personal Income Tax Rate. The changes include a new top individual income tax rate of 35 on income over IDR 5 billion in addition to an increase in the upper threshold for the 5 rate from IDR 50 million to. Contributions to the Indonesian Social Health Insurance Badan Penyelenggara Jaminan Sosial or BPJS system are deducted from a taxpayers taxable income.

The Tax tables below include the tax rates thresholds and allowances included in the Indonesia Tax Calculator 2022. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for. ICalculator ID Excellent Free Online Calculators for.

Taxable Income Rate Up to Rp 50000000 5 Over Rp 50000000 but not exceeding Rp 250000000 15 Over Rp 250000000 but not exceeding Rp 500000000 25 Over Rp 500000000 30. However the reduction in corporate income tax rates can motivate company management to carry out earnings management in order to save the tax burden. This income tax calculator can help estimate your average income tax rate and your take home pay.

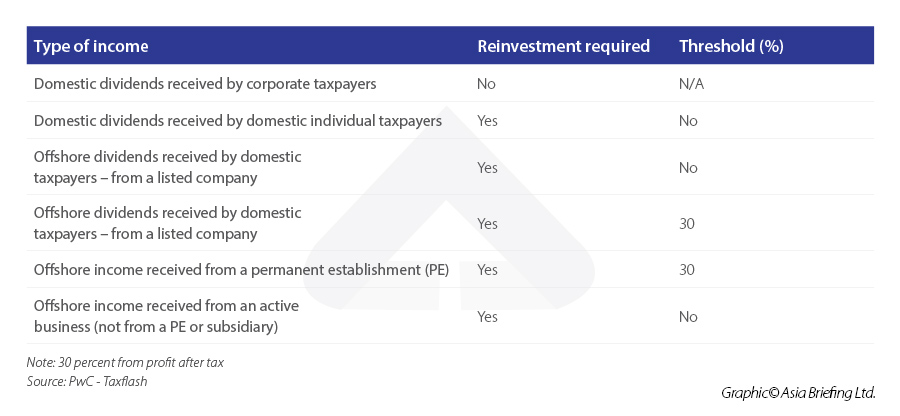

However there are several exemptions. The Income tax rates and personal allowances in Indonesia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Foreign companies without a PE in Indonesia have to settle their tax liabilities for their Indonesian-sourced income through withholding of the tax by the Indonesian party paying the income.

Indonesia Salary Calculator 202223 Calculate your take home pay in Indonesia thats your salary after tax with the Indonesia Salary Calculator. Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed on 20. Indonesia Income Tax Rates and Personal Allowances Review the latest income tax rates thresholds and personal allowances in Indonesia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in.

The individual income tax rate in Indonesia is progressive and ranges from 5 to 35 depending on your income for residents while non-residents are subject to a 20 flat tax rate. 26 WHT of 20 is applicable. Corporate income tax CIT rates A flat CIT rate of 22 generally applies to net taxable income.

For resident taxpayer the top marginal income tax rate is 30 for income above IDR 500 million. Review the 2021 Indonesia income tax rates and thresholds to allow calculation of salary after tax in 2021 when factoring in health insurance contributions pension contributions and other salary taxes in Indonesia. Normal rate of taxation in Indonesia corporate income is 25.

Companies that have a gross turnover below 50 Billion IDR have a discount on 50 from the standard corporate income tax in other words 125. A quick and efficient way to compare salaries in Indonesia review income tax deductions for income in Indonesia and estimate your tax returns for your Salary in Indonesia. The government has set a policy of reducing the Corporate Income Tax rate a year earlier than the Omnibus Law to deal with the impact of the Covid-19 pandemic that has hit Indonesia since March 2020.

Article 2326 Income Tax PPh 2326 Domestic Article 23 WHT is payable at the rate of 2 for most types of services where the recipient of the payment is an Indonesian resident and 15 for a variety of payments to resident corporations and individuals. Income Tax in Indonesia in 2022. The Income tax rates and personal allowances in Indonesia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

How many income tax brackets are there in Indonesia. 07 Jan 22 From January 2022 new progressive income tax rates come into effect in Indonesia. Income Tax in Indonesia in 2020.

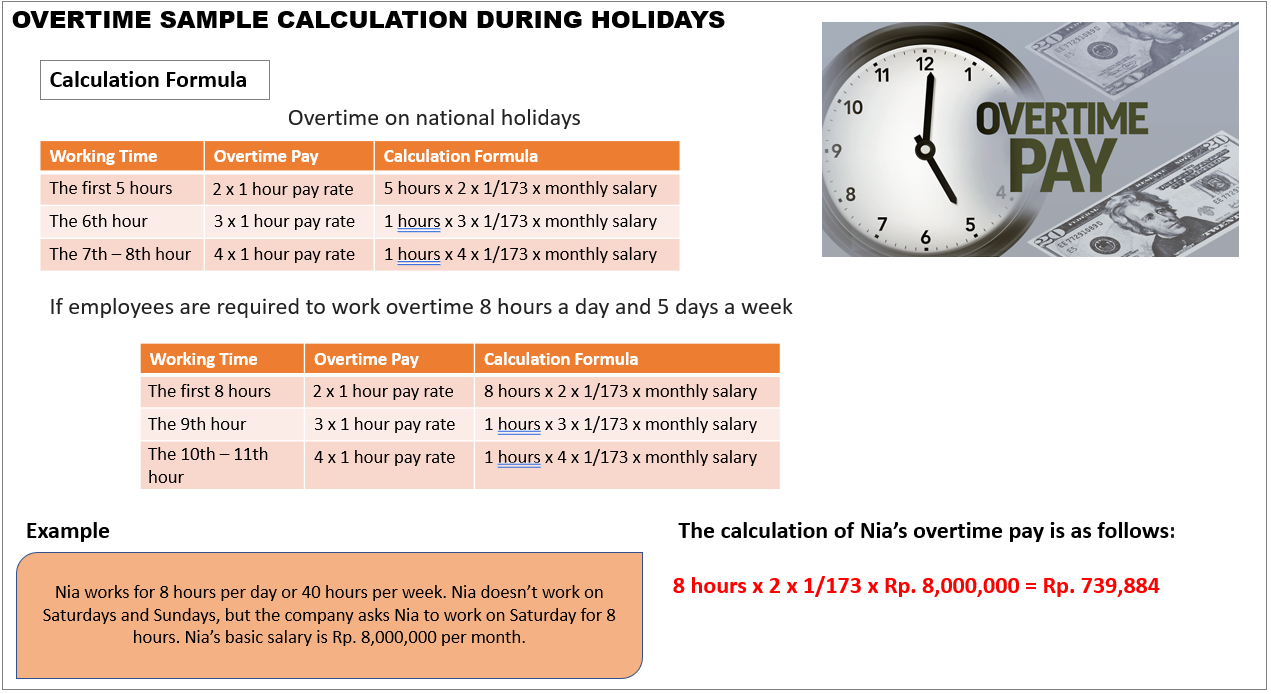

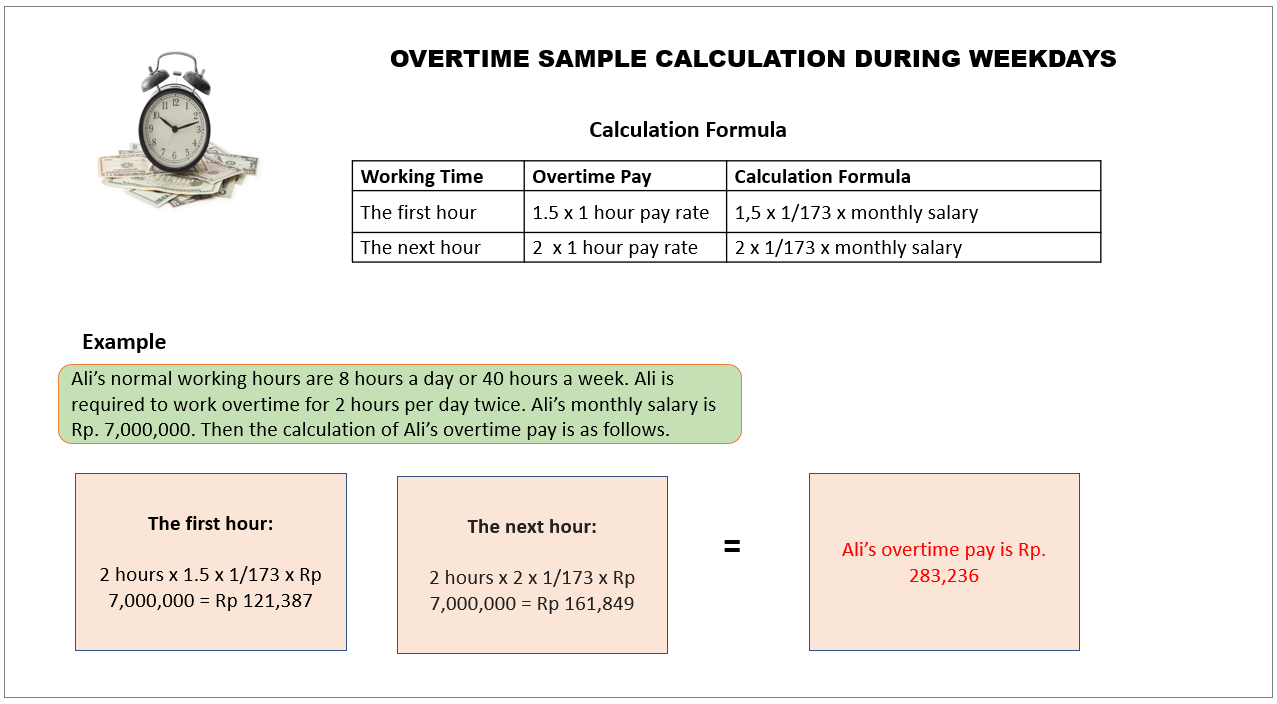

An employee makes a 2 contribution from their salary while the employer makes a 37 contribution. Below are applicable income tax rate for individual taxpayer.

Corporate Income Tax In Indonesia Acclime Indonesia

China Annual One Off Bonus What Is The Income Tax Policy Change

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Indonesia Income Tax Rates For 2022 Activpayroll

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Indonesia Payroll And Tax Guide

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Tax Identification Numbers In Laos Compliance By June 2021

Indonesia Payroll And Tax Guide

Indonesia Payroll And Tax Guide

Personal Income Tax Pit In Indonesia Acclime Indonesia

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Personal Income Tax Pit In Indonesia Acclime Indonesia

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia